- Reminders

- Whisky

- Blog

Investing In Whisky: Bottles vs. Casks

If you are new to whisky investment, you might not have considered one of its major avenues – investing in casks. There are some differences between investing in whisky bottles and casks, with each option presenting unique opportunities and challenges; we want to help you understand the benefits and considerations of each to help guide your investment decisions.

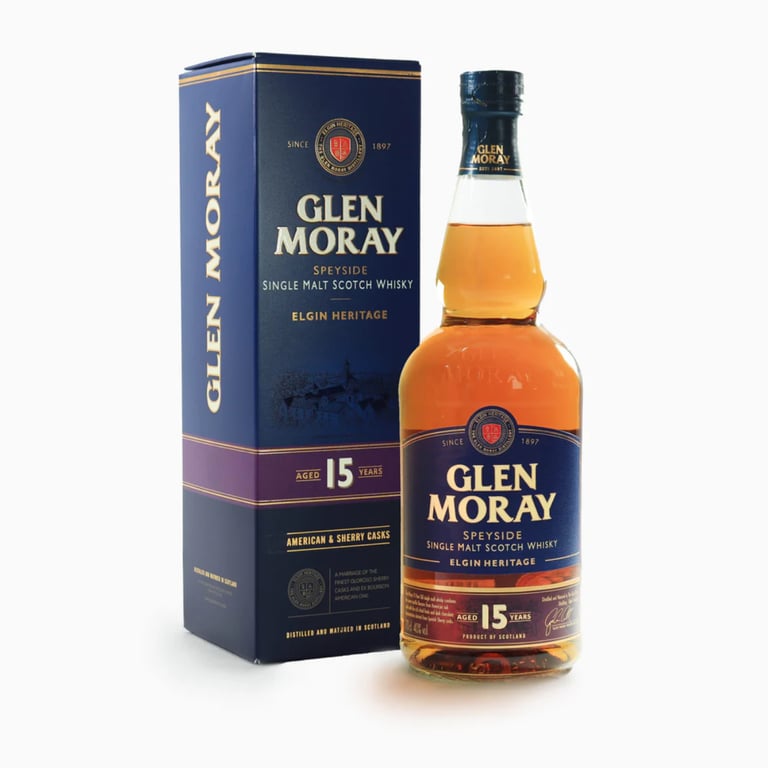

The Whisky Bottle Investment Landscape

Investing in whisky bottles involves purchasing individual bottles that are often rare, limited edition, or highly acclaimed. While some bottles do indeed come with high prices, the initial costs are relatively lower compared to casks, making this type of investment accessible to a wider range of investors. Bottles can be acquired from retail stores, online platforms, auctions, and directly from distilleries. The secondary market for whisky bottles is well-established, providing ample opportunities for buying and selling. Collectors typically focus on bottles from renowned distilleries, limited releases, and those with unique packaging or historical significance.

Advantages and Considerations for Whisky Bottles

1. Accessibility:

Investing in bottles is relatively straightforward. You can purchase bottles from retail stores, online platforms, auctions, or directly from distilleries. This ease of access makes it a practical entry point for new investors.

2. Immediate Ownership:

When you buy a bottle, you immediately own a tangible asset. This allows for immediate appreciation in value, especially if you purchase limited editions or rare releases.

3. Lower Initial Investment:

Bottles generally require a lower initial investment compared to casks. This makes bottle investment more accessible to a wider range of investors.

4. Market Liquidity:

The secondary market for bottles is well-established. Platforms like whisky auctions and online marketplaces provide liquidity, making it easier to buy and sell bottles.

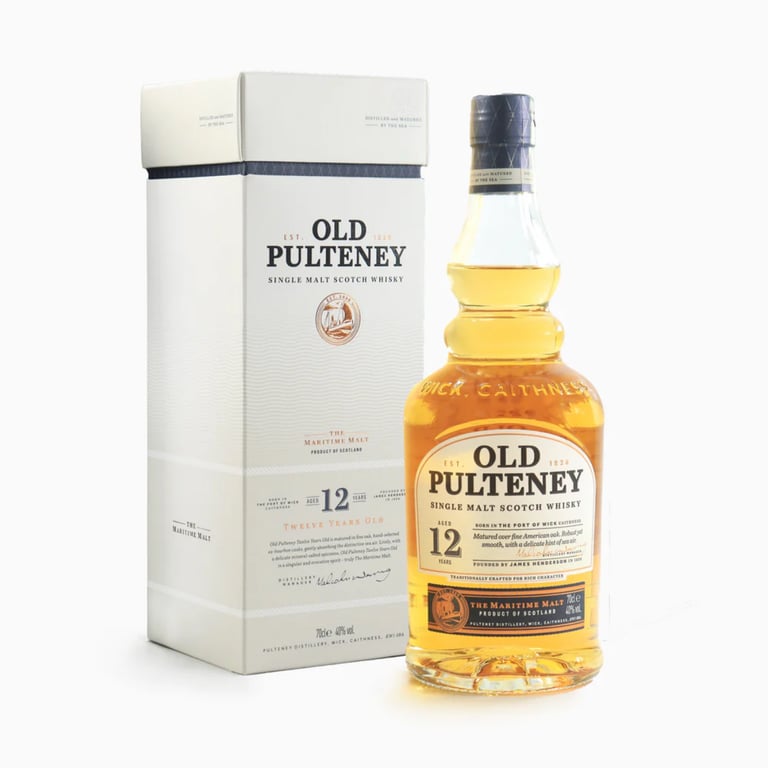

Considerations

1. Storage:

If you want to preserve the quality and value of a bottle, you must have the means to properly store it. Bottles should be kept upright in a cool, dark place with stable temperature and humidity.

2. Market Volatility:

It is dangerous to assume that a bottle you have invested in will always appreciate as the value of whisky bottles can be subject to market fluctuations. Trends and collector preferences can change, impacting the resale value.

3. Condition Sensitivity:

The value of a bottle can be significantly affected by its condition. Damaged labels, seals, or packaging can reduce its market value. This is why proper storage, as mentioned, is crucial.

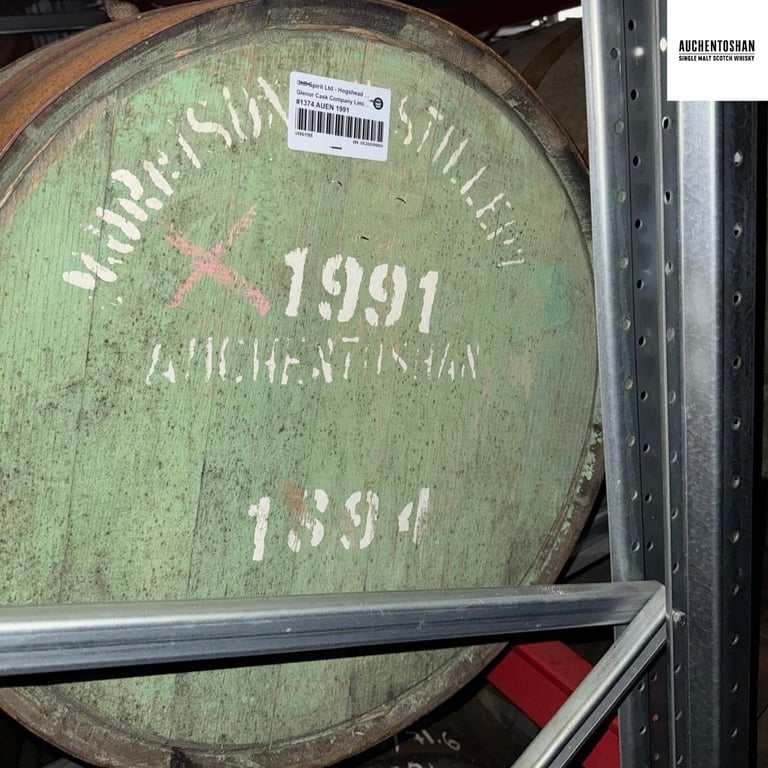

The Cask Investment Landscape

Investing in whisky casks involves purchasing entire casks of whisky that are still maturing. This type of investment requires a higher initial outlay but offers the potential for significant appreciation as the whisky ages. Cask investment allows for greater involvement in the whisky-making process, including decisions on aging duration and cask finishing. The market for cask whisky is less liquid than for bottles, and it involves additional considerations such as storage, insurance, and eventual bottling costs. This might make it seem daunting, but cask investment can yield substantial returns and offers a unique and personalized investment experience.

Advantages and Considerations for Cask Investment

1. Potential for Greater Appreciation:

Casks have the potential for significant appreciation as the whisky continues to mature. The aging process can enhance the flavor and quality, making the whisky more valuable over time.

2. Customization:

Owning a cask allows for customization. You can decide on the aging duration, type of cask used for finishing, and even bottle the whisky under a private label.

3. Bulk Investment:

Investing in a cask means you own a large volume of whisky. This can be beneficial if you plan to bottle and sell the whisky in smaller quantities over time.

4. Unique Investment:

This is an investment that others will likely be very intrigued by. Cask ownership offers a unique and personalized investment experience. It’s an opportunity to be involved in the whisky-making process, often including distillery visits and sampling your cask’s progress.

Considerations

1. Higher Initial Investment:

Casks require a higher initial investment compared to bottles. The cost includes the whisky itself, storage, insurance, and eventual bottling expenses.

2. Long-Term Commitment:

Cask investment is a long-term commitment. The whisky needs time to mature, often several years, before it can be bottled and sold.

3. Storage and Maintenance:

Proper storage and maintenance are critical. Casks must be stored in bonded warehouses, and there are ongoing costs for storage, insurance, and potential evaporation loss (known as the “angel’s share”).

4. Market Complexity:

Selling cask whisky can be more complex than selling bottles. The market for casks is less liquid, and finding buyers can be more challenging. Additionally, the process of bottling and labeling adds to the complexity and cost.

While both bottles and casks offer unique opportunities and challenges for whisky investors, ultimately, the choice between bottles and casks depends on your investment goals, budget, and level of commitment. If you are a new investor or want to make a smaller and more straightforward investment, investing in bottles might be more suitable for you. On the other hand, if your main goal is investing in something that has a higher chance of having greater appreciation in the future and are willing to spend time and money, casks might be for you. Diversifying your investment portfolio by including both bottles and casks can also be a strategic approach. Here on WhiskyGenius, we have options for both investors seeking bottles and those seeking casks. Explore our bottle and cask options and find the best fit for you!

Please enjoy whisky responsibly.

Banner photograph from The Beer Connoisseur.

More Content

View More