- Reminders

- Whisky

- Blog

How to Determine if a Whisky is a Good Investment

You have done your research and feel ready to make your first whisky investment when you are met with an abundance of options to choose from. With so many different brands, types, and ages, it can be tricky to decide which exact whisky might make a good investment. In this article, we have compiled a list of some key characteristics that can be considered when assessing the investment opportunity that a whisky can present; this way, you can better understand whiskies as a whole and from an investment perspective.

Brand/ Distillery Reputation and History

Established Names:

The Macallan, Glenlivet, Glenfarclas... these are all brands that are probably familiar to you and many others. Certain whisky brands have established themselves with long-standing traditions of excellence, and investing in whiskies from these distilleries can lead to more stable returns. WhiskyGenius is home to many reputable brands including those mentioned above, making it easier for investors like you to find and purchase valuable whisky. The WhiskyGenius blog also has articles about the history and story of distilleries like Glenlivet so you can learn more about specific brands you are interested in.

Innovative Distilleries:

Conversely, newer or less traditional distilleries that produce innovative and high-quality whiskies can also be seen as attractive investment opportunities. Although you might have never heard of them before, distilleries such as Kilchoman or Bruichladdich are gaining reputations for their craft and creativity, and their limited releases can become highly sought after as they gain more popularity and recognition.

Unique Production Methods:

However, some distilleries still use their own traditional production methods, and that also makes their whiskies unique. For example, Yoichi Distillery in Japan is one of the only distilleries in the world to still use direct coal-fired pot stills. This practice, while traditional and now uncommon, is what makes Yoichi’s whiskies stand out. Whiskies that feature unique elements are often considered valuable due to their distinctiveness and the craftsmanship involved.

Yoichi’s coal-fired pot stills. Photograph from Japan Guide.

Age and Maturation

Age:

As we mentioned in our article “How Whisky is Made”, maturation is a key step in whisky production. Not only does it give the whisky more complex flavors, but older whiskies are rarer, making them generally more valuable in the eyes of collectors and enthusiasts. For instance, in 2019, a 12-year-old Glenfiddich single malt was worth $36, while a 50-year-old Glenfiddich single malt bottle was worth $30,000. WhiskyGenius currently has whisky bottles with ages ranging from 12 years to 72.

Maturation Quality:

Take the Macallan Sherry Oak Series, for example; it’s in the name – the whisky is aged in sherry-seasoned oak casks, giving it a unique and complex flavor. Whiskies that have been meticulously aged in high-quality oak casks often produce higher prices as consumers gravitate towards interesting and unique tastes that can only be achieved by these special maturation processes.

Rarity and Exclusivity

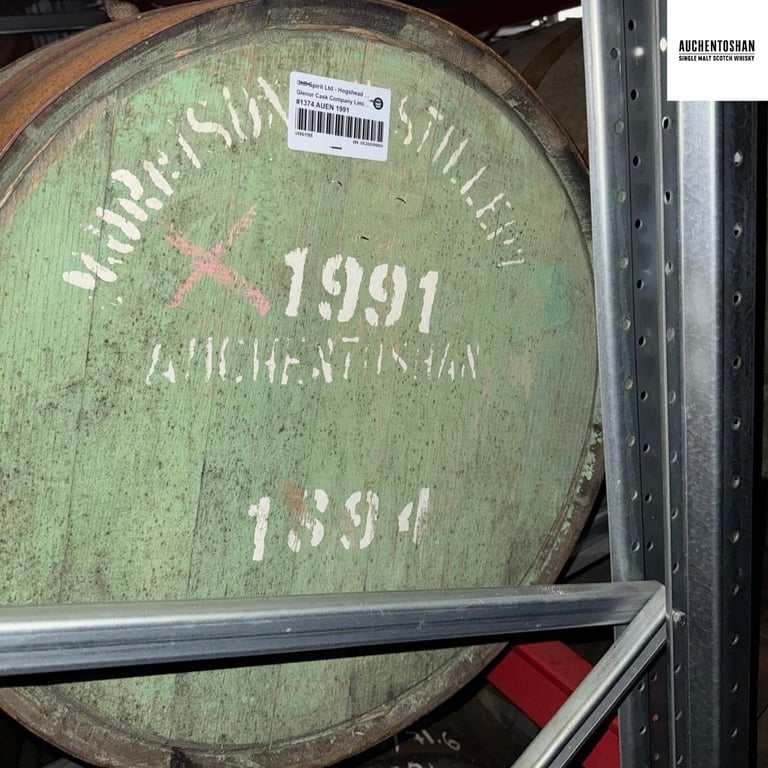

Limited Editions and Single-Cask Releases:

When you know that something is limited in quantity and will not be reproduced, the allure of obtaining it for yourself increases. This is why limited editions and single-cask releases are often more valuable; they are impossible, or very difficult, to get ahold of after they have sold out. For instance, Sotheby’s sold two bottles of The Yamazaki 18-Year-Old in one day. One sold for $875, and another for $1,375. The main difference was that the second one was a limited edition, making it more exclusive and rarer and thus valuable.

The Yamazaki 18-Year-Old and the Yamazaki 18-Year-Old Limited Edition. Photograph from Sotheby’s.

Closed Distilleries:

Whiskies from distilleries that are no longer operating are similar to limited edition whiskies in that they will not, or in this case cannot, be reproduced in the future. This rarity can encourage collectors to spend substantial amounts of money on these whiskies. For example, Karuizawa, a small Japanese distillery, closed in 2000; in 2020, one of its whiskies set a record as the most expensive Japanese whisky to be sold at auction.

Condition and Packaging

Bottle Condition:

Put yourself in the shoes of a collector; when presented with two bottles – one with an intact seal and label, and one without – which would you prefer to have in your collection? A bottle in good condition can make a whisky a good investment as collectors often attach value to the bottle's condition.

Original Packaging:

Similarly, a bottle is more valuable when it comes with original packaging, such as special edition cases or wooden boxes. Collectors often value complete sets with their original packaging, so well-preserved packaging can significantly impact a whisky’s market value. For example, Sotheby’s sold five bottles of the Macallan-Glenlivet Gordon & MacPhail 40-Year-Old on the same day. Three were auctioned with their original boxes and sold for $960-$1790 more than the other two that did not include original packaging.

The Macallan-Glenlivet Gordon & MacPhail 40-Year-Old with original packaging, sold by Sotheby’s for $6600. Photograph from Sotheby’s.

Market Demand and Trends

Current Trends:

While identifying whisky trends might not always be straightforward, there are many ways to get an idea of which whiskies are gaining popularity. These include monitoring social media and online forums and discussions, reading whisky-related publications, looking at sales data from major retailers and platforms, attending events and tastings, and even keeping in mind current cultural and economic trends. Taking these steps can help you keep up with current market trends and help identify whiskies that have greater potential to appreciate. For instance, there has been a trend of growing interest in Japanese whiskies and craft releases from boutique distilleries in recent years.

Auction Results and Sales Data:

Another way to track whisky trends is by looking through past auction results. You might often see news of expensive bottles of whisky being sold at auctions, but you can further explore these auctions and their results by directly checking auction house’s websites. This can provide valuable insights into which whiskies are currently in demand and have potential for future appreciation. Auctions to keep an eye on include Sotheby’s, Bonhams, Whisky Auctioneer and Unicorn Auctions, among others. Additionally, tools such as market performance indices, available through resources like Rare Whisky 101, can offer beneficial data and help track these trends over time. Rare Whisky 101 even has a Whisky Investors Index showing which distilleries are performing best as investments.

Flavour Profiles and Reviews

Although we’ve discussed the importance of a whisky’s bottle and packaging, ultimately, the original purpose of whisky is to drink it, so highly rated whiskies with exceptional flavour profiles are more likely to be sought after by collectors and enthusiasts. Check reviews and ratings from reputable sources like whisky critics and publications, and pay attention to any awards or accolades the whisky has received.

Practical Steps for Evaluating Whisky Investments

Though purchasing whisky can be exciting, we recommend researching and educating yourself about whisky first. Immerse yourself in knowledge by reading books, following industry news, and learning about different distilleries, regions, and production methods. Participate in whisky auctions, festivals, and tasting events to see high-value whiskies, learn from experts, and observe market dynamics. Start with smaller investments in reputable whiskies to build your confidence and understanding of the market, then gradually expand your collection as you gain experience.

It is also a good idea to diversify your collection by investing in a variety of whiskies from different distilleries, regions, and styles to spread risk and increase potential returns. Keep detailed records of your purchases, including details about the whisky’s provenance, condition, and market value. This information is crucial for future resale and valuation.

Rarity, age, distillery reputation, market trends, and historical performance all contribute to a whisky’s potential for appreciation and can be studied and researched to decide whether a whisky would make a good investment. By carefully considering these factors, you can turn your enthusiasm and passion for whisky into a great financial opportunity.

Want to learn more about the basics of whisky and what differentiates one type of whisky from another? Visit the WhiskyGenius blog for various articles about whisky production, flavors, region and more to help you get started on your whisky investment journey.

Please enjoy whisky responsibly.

Banner photograph from BBC.

More Content

View More