- Reminders

- Whisky

- Blog

How Do I Assess the Value and Potential Appreciation of a Whisky?

Bottles of whisky differ from each other in many ways – flavour, rarity, production methods and region, and most importantly for investors, value. However, there are no concrete ways to determine the exact value and future appreciation of a whisky, so how do you decide which bottles to invest in? There are various factors to look at to predict a whisky’s value and potential appreciation, so whether you are a seasoned collector or new to whisky investment, we hope that this article helps you feel confident in the whiskies you choose to invest in.

1. Analysing Market Trends

Identify Emerging Trends and Consumer Preferences:

Your whisky palate has likely changed throughout your life, and other consumers’ tastes evolve too. This leads to trends that can indicate and help you identify which whiskies might appreciate as demand increases. For instance, Japanese whiskies and craft whiskies from boutique distilleries have gained significant popularity in recent years.

Monitor Market Activity:

Stay informed on the latest whisky news with publications such as Whisky Advocate, Whisky Magazine, and Drinks International. For those of you who are not only passionate about investing in whisky but also the craft of whisky itself, the yearly Malt Whisky Yearbook is a good source of both statistics and interesting reads.

2. Reviewing Historical Data and Auction Results

Analyse Historical Performance Data:

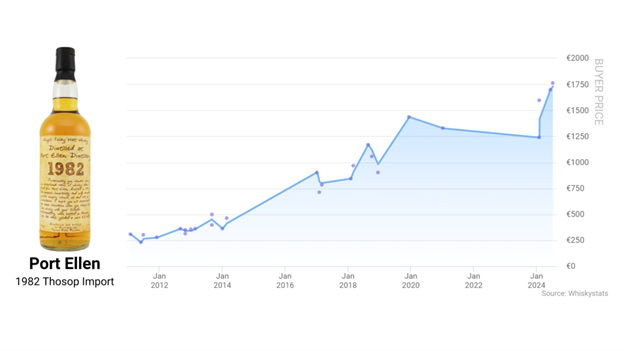

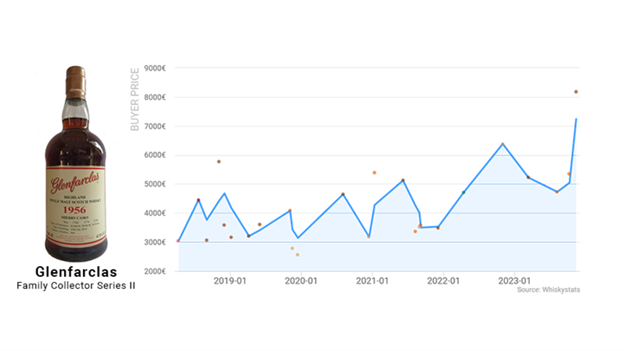

To predict how a whisky might perform in the future, it can help to look to the past and how different whiskies have appreciated historically. Some whiskies appreciate relatively steadily, such as the Port Ellen 1982, while others experience more volatile price changes, such as the Glenfarclas Family Collector Series II. Resources like Whiskystats, which creates graphs with data ranging back to 2012, can allow you to see exactly how certain whiskies have performed in the past.

Appreciation of the Port Ellen 1982 Thosop Import vs. the Glenfarclas Family Collector Series II shown in graphs. Both have appreciated over time, but one more steadily than the other. Graphs by Whiskystats.

Review Auction Prices:

Want to assess whether a whisky might gain or lose value? Analyse recent auction prices for the whisky you are considering or for whiskies of similar age, brand, and rarity. High prices at auctions for similar bottles can indicate strong market interest and potential for future appreciation. For example, Sotheby’s sold the Macallan M Decanter 2018 Release for $3200 in October 2020 and $3750 in December 2023. The $550 increase suggests that this bottle has become more coveted in the past two years.

Auction Frequency:

If you frequently see a particular whisky at auctions, that can indicate that there is strong or growing interest in that whisky. They are also more likely to appreciate in the future. Whisky Advocate’s auction updates reveal the 20 highest hammer prices of each month, where it is revealed which rare and high-end whiskies are frequently selling for high prices. Between April and August 2024, Old Rip Van Winkle, Karuizawa, and Macallan all frequently appeared on these lists, showing their current demand in the luxury whisky market.

3. Using Performance Indices

Review Market Performance Data:

Performance indices provide data on price trends, appreciation rates, and market dynamics. For example, Rare Whisky 101 provides detailed market performance indices that track various whiskies by region and distillery. These indices can offer valuable insights into which whiskies are in demand and have appreciated, thus helping identify high-potential investment opportunities.

Benchmarking Performance:

If you are already considering a whisky, you can also use performance indices to benchmark it against others in the market. This comparative analysis helps determine whether a whisky is likely to outperform or underperform relative to similar bottles.

4. Assessing Condition and Provenance

Evaluate Bottle Condition:

Collectors and investors prefer bottles that remain as close to their original condition as possible, so whisky bottles that are in excellent condition, with an intact seal, clean label, and original packaging tend to be more valuable. For example, two bottles of the Macallan 1926 Fine & Rare were sold by Sotheby’s only one year apart, yet one sold for $1.9 million, and the other for $751,000. The main difference between the two bottles was the condition of each bottle and its packaging.

A bottle of Macallan 1926 Fine & Rare in good condition, with an undamaged label and original packaging. Photograph from Macallan.

Verify Provenance:

Collectors often want to know the history of a whisky’s ownership and storage to ensure that it is authentic and has been taken care of properly. This is known as provenance, which adds credibility and value to a whisky. Documentation such as certificates of authenticity, purchase records, and detailed storage history can act as evidence. Purchasing whisky bottles and casks from marketplaces such as WhiskyGenius can help ensure the provenance of the whisky is clear and well-recorded. At WhiskyGenius, you can purchase a digital token that represents ownership of a physical bottle or cask, which allows anyone to verify their authenticity on the public blockchain, making it impossible to replicate or copy.

5. Leveraging Expert Insights

Consult Whisky Advisors:

If whisky investment is new to you and you feel unsure about where to start or want a better understanding of the market, you can consider reaching out to whisky investment advisors or consultants. As experts with an eye for valuable whiskies worth investing in, they can help you spot emerging opportunities that others might overlook. For instance, Blair Bowman, a whisky expert, author, and founder of World Whisky Day, provides a consultation service to help you learn about and choose the best whiskies, as well as provide insights into global trends to help with your whisky investment.

Network with Collectors:

Want a more hands-on way to learn more about the different elements of whisky? There are various whisky clubs around the world that give you access to both educational resources and events such as tastings. Members of The Scotch Malt Whisky Society, for example, enjoy access to Members’ Rooms, which not only allow them to network with other whisky enthusiasts, but also talk with staff who have extensive knowledge about whisky, ultimately leading you to discover new whisky and investment opportunities.

There is no guaranteed way of knowing the exact value and appreciation of a whisky when purchasing it. However, factors such as the ones stated above can help you make educated predictions and informed decisions about which whiskies to invest in based on your goals and preferences. With these practical steps, you can start your journey of investing in whisky right here on WhiskyGenius. Who knows what treasure you might uncover?

Please enjoy whisky responsibly.

Banner photo from Barschule Freiburg.

More Content

View More